Explain: How Long Does It Take to Build Credit?

Nov 24, 2023 By Triston Martin

Introduction

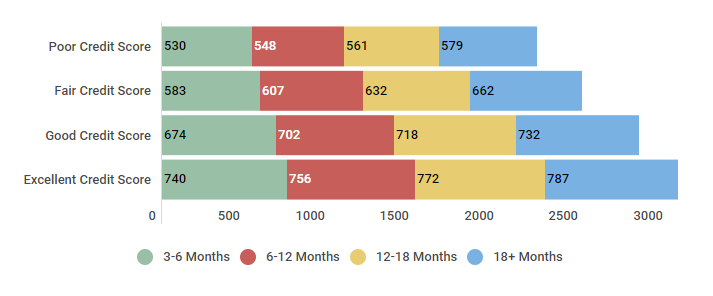

How long does it take to build credit score? The only way to start with a blank slate and create a positive credit history is to utilize credit. This includes getting and using a credit card and taking out and repaying a loan. Around six months of credit use is required to generate a FICO credit score, which is used in around 90% of loan decisions. A decent FICO credit score is over 700, with scores between 300 and 850 considered excellent. A score of 800 or higher is exceptional. Try to keep your hopes up manageable for an initial sum. A credit score can be generated with less than a year of credit history, but it takes years of responsible credit use to earn a good or exceptional score.

Methods for Improving One's Credit Rating

Are you wondering how long does it take to build credit? To improve your credit score, you need only have accurate information added to your credit report. Maintaining a good credit history is just as crucial as establishing one, so here are some best practices to follow once you've established credit.

Examine Your Credit Reports

The first step in repairing your credit is identifying any factors already working in your favor. That is why it is essential to examine your credit report. Get your credit history from all three major national credit reporting agencies (Equifax, Experian, and TransUnion). The next step is to review each report and determine how it affects your grade. On-time payments, low balances, various credit accounts (including both credit cards and loans), account age (the longer, the better), and minimal queries all contribute to a good credit score. Negative aspects of a credit history include overdue payments, large amounts, collections, and judgments.

On-Time Bill Payment Is Imperative

Creditworthiness is based primarily on a consumer's payment history. Keep up your on-time bill payment history of keeping your score high. When a bill is more than 30 days past due, the creditor has the right to notify the main credit bureaus. This can have a devastating effect on your credit score.

Make Sure You Don't Cancel Any Credit Card Accounts

Building a credit history from scratch takes time, but time is on your side when you are a credit novice. If the yearly fee is waived, keep the account open even if you decide that you no longer want or need the card a year from now. If you have been using credit for a long time, that will reflect well on your FICO score.

Make a Fresh Credit Application Sparingly

Lenders often run a thorough credit check whenever someone applies for credit. If you frequently check your credit, you may see a temporary decrease in your score after each inquiry. Limit new credit applications to times when you genuinely need them.

You Should Only Request a Fair Price

Credit cards should be used responsibly and not as an excuse to go on an uncontrolled spending binge. If you want to start developing credit, grab a credit card and use it for low-cost things you can quickly pay off monthly. Credit usage ratio (the amount of debt you have about your total credit limit) is the second most influential component in determining your credit score. Thus responsible use and timely payments are crucial.

Make Sure Your Use Is Legal By Requesting To Be Added To The List Of Permitted Applications

If you have a reliable friend or family member who has higher credit than you have, you might seek to be added as an authorized user to one of their credit cards. If they did that, their whole payment history with the card would be shown on their credit report, which might raise their score. A credit card will be issued to you, but you are free to return it to your loved one or friend anytime.

Why Does It Take So Long to Build a Solid Credit History?

Changes to your credit score take time to happen. The reason for this is that credit ratings reflect your history of using credit. Lenders look at your credit report and score to see if you are a safe bet with money. For instance, keeping your credit card payments current for a single month can have a positive effect. But making regular, on-time payments over an extended period can have an even more significant, beneficial impact on credit. And that can improve lenders' confidence in your ability to handle debt.

Conclusion

Now you have learned how long does it take to build good credit? It usually takes some time to establish your first credit score. The good news, though, is that it is achievable. When you have found a good credit history, maintaining it requires diligent attention to monthly repayments and other financial information. Good credit takes time to build. If you follow the steps above to improve your credit score and steer clear of the hazards, your score should rise. If you apply for credit properly, pay your debts on time, and maintain your balances low, you can get the most out of your early credit-building years.