Effective Strategies for Managing Receivables

Oct 01, 2024 By Verna Wesley

In the present economic situation, companies are more and more dealing with the problem of increased late payments. This makes managing cash flow effectively more crucial now than ever before. As a greater number of customers default on their dues, businesses have to adjust how they handle their incoming money to keep financial stability intact. In this article, we discuss practical methods for getting maximum income from receivables while also tackling the increasing issue of overdue amounts so that your company stays strong during difficult periods.

Understanding the Impact of Rising Delinquencies

When clients do not pay on time, it can greatly impact a company's cash flow and total financial wellness. This situation may cause a chain reaction that results in more operation difficulties as well as possible problems with liquidity. Oftentimes times companies encounter limited funds to fulfill their duties which can disturb the daily activities of the business. To lessen these dangers, companies must get a strong grasp of how their customers pay and the aspects that cause delayed payments. Finding out trends in tardy payments can let businesses modify how they collect money, thereby improving the likelihood of getting back unpaid amounts.

- Identify Key Accounts: Prioritize tracking customers with historically late payments to reduce future risks.

- Adjust Credit Terms: Consider revising credit terms for high-risk clients to safeguard cash flow.

Establishing Clear Payment Terms

The basic step to increase receivables is at the beginning of any customer interaction, it should be specified with clear terms about payment. Companies need to make customers understand deadlines for payments, penalties if they delay, and rewards when they pay early. This not only forms a guideline for customers but also acts as evidence in future talks related to delayed payments. Moreover, keeping clearness about payment procedures promotes confidence between companies and their clients. Continually going back to these terms and discussing them can stress their importance and remain at the forefront of customers' thoughts.

- Avoid Ambiguity: Ensure terms are explicit to prevent miscommunication on due dates or penalties.

- Offer Early Payment Discounts: Encourage faster payments by offering small incentives for early settlements.

Implementing Effective Credit Policies

Putting strict credit rules into action is very important for successful control of receivables. Business firms must evaluate the ability of possible customers to pay back debts before giving them a line of credit. By performing detailed background investigations and checking financial wellness, businesses can reduce risk related to future payment failures. After the establishment of credit policies, regular inspection of customer accounts becomes essential. This involves keeping records of payment history and spotting customers who might have a chance to lag in payments. Taking anticipatory measures with such potentially problematic customers can aid in stopping late payments from increasing further.

- Run Periodic Credit Checks: Reassess clients' financial health regularly to stay ahead of potential risks.

- Limit Credit Exposure: Set credit limits for new clients until a payment history is established.

Utilizing Technology for Enhanced Cash Flow Management

Using technology in managing money flow procedures can give important advantages for increasing payments that are due. A lot of companies nowadays use software solutions that automate making invoices, reminding about payments, and keeping track of them. These tools make the process more efficient by decreasing manual work time, thus letting businesses concentrate on their main operations. Furthermore, technology can improve the interaction with customers by giving them self-service options to handle their accounts. This may result in faster payments because customers can effortlessly check their payment history and due amounts. Routine reporting and analysis can shed light on trends of payments too, allowing businesses to modify their plans as necessary.

- Use Automation Tools: Automate reminders and follow-ups to ensure timely payment collection.

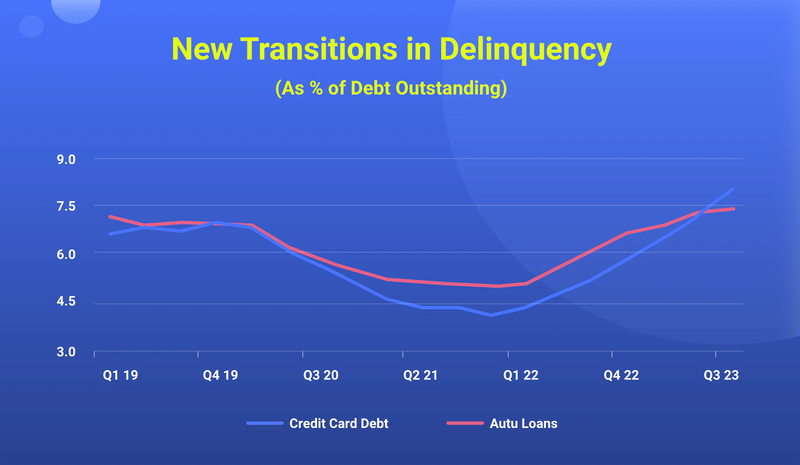

- Leverage Analytics: Regularly review payment data to detect emerging trends in delinquencies.

Fostering Strong Customer Relationships

To manage cash flow successfully, it is very important to have good relationships with your customers. Communication should always be clear and businesses must ask their clients to communicate if they have any worries about when payments will be made. When businesses know why there are payment delays, they can create solutions that benefit both them and the client. Giving payment plans that are adaptable or different ways to pay can make it easier for payments to be made on time. Interacting with customers frequently is not only good for earning their trust but also critical in getting helpful suggestions on how companies can better serve them. This contributes heavily towards encouraging more successful transactions.

- Encourage Open Communication: Make it easy for clients to discuss payment challenges before they escalate.

- Customize Payment Plans: Provide alternative payment options to meet customer needs without compromising cash flow.

Monitoring and Reviewing Receivables Regularly

Constant checking and evaluation of receivables is very important for spotting patterns and taking fast remedial steps. Companies should create a regular process to look over unsettled accounts, as well as estimate the total health of their portfolio in terms of receivables. This involves studying how long it takes for money owed by customers to be received, and figuring out which clients often delay payments. If businesses continue this supervision, they can organize their collecting tasks in a good way, taking care of the most important accounts at first. Also, doing usual checks could aid in finding possibilities to get better with billing and payment methods. This allows firms to make operations smoother and improve their cash flow.

- Create Aging Reports: Use aging reports to categorize overdue receivables and focus on the oldest accounts first.

- Schedule Regular Reviews: Conduct monthly or quarterly reviews of receivables to spot issues early.

Conclusion

By applying these methods, companies can properly manage the issues caused by increasing defaults and at the same time enhance their receivables. It is crucial to define clear payment conditions, apply good credit rules, use technology efficiently, build strong relationships with customers, and regularly check accounts to safeguard a robust cash flow. As economic scenarios keep changing over time, being flexible towards these changes will be essential for sustaining financial steadiness and progression.